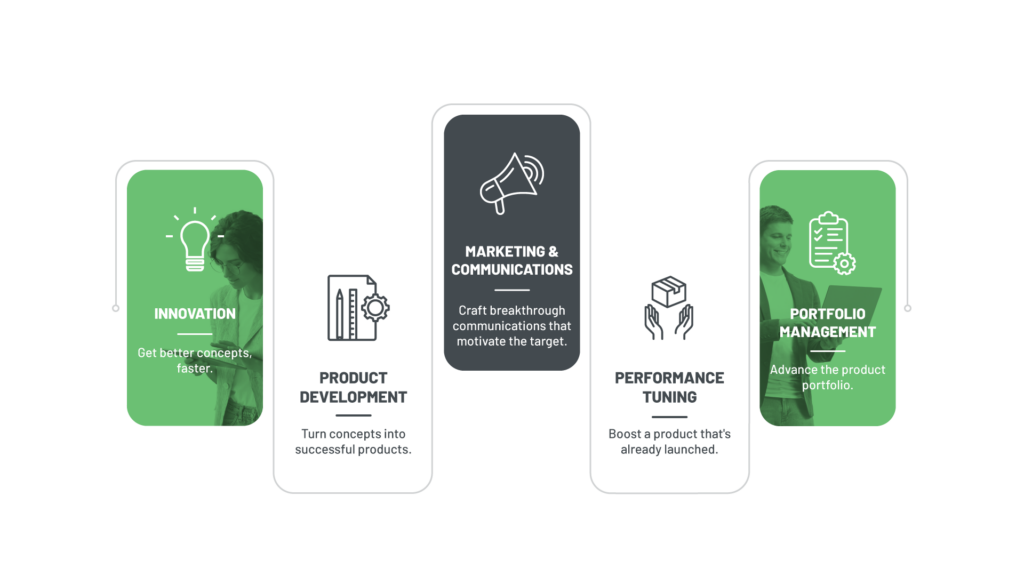

Qualitative research is a critical component of the product life cycle. Better information ensures the benefits delivered by the product are those demanded by the market and supports the innovation and communication needed to ensure the product stays fresh and top of mind.

While there are many ways to approach your customers and their journeys, we often recommend a few methodologies to address the research needs at each stage of the process.

Innovation

- Immersion – To thoroughly understand the consumer or a key segment, consider a deep dive. This might involve mobile ethnography, focus group, onsite observation or a mixed-method approach.

- Meta-Analysis – Analysis of existing research, both primary and secondary, or social media listening can provide a quick, low-cost read on the consumer pulse.

- Ideation – Generate ideas with a brainstorming session grounded in your consumer insights.

- Concept Evaluation and Optimization – Expose early drafts of your ideas to your consumers before capital investment. This research can be done qualitatively, quantitatively or with a hybrid approach.

Product Development

- Product Testing and Refinement – Creating several iterations of a new product and testing them with consumers can be conducted via in-person focus groups, in-home use tests, mobile ethnographies, and similar techniques.

- Preliminary Positioning, Name, and Package Design Research – Once the value proposition is set, the critical work of positioning the product begins. Naming and package design research ensure the product delivers on key benefits.

Marketing

- Communication Checks – To minimize groupthink and get unbiased and unaided reactions to stimuli, we recommend individual in-person or webcam depth interviews or a combination of a quantitative survey with in-depth individual digital chats.

- Positioning and Packaging Work – A variety of methods can be employed here, including online discussions, webcam interviews, or individual text-based chats.

- Disaster Checks – Once you have a fully developed plan, one last “disaster check” of the marketing is often useful. This usually involves a handful of webcam or text-based interviews.

- Promotional Testing – At this phase, you may wish to evaluate the potential value of possible promotions to boost your launch.

Performance Tuning

- Market Structure Studies – Review the competitive landscape and the degree to which products resonate with category loyalists and newbies.

- Qualitative Market Segment Deep Dives – Perhaps there is an emerging segment using your product in unexpected ways or a segment using your product in combination with another. Methods such as in-home use tests, mobile ethnographies, and shop-a-longs allow you to see the product in use and in context.

Portfolio Management

- Brand Perception – Group discussions, whether traditional focus groups or online discussions, can explore current brand perceptions relative to other brands in the category.

- Competitive Positioning – Focus groups, either in person or online, and in-depth video interviews or individual chats allow deep exploration comparing value propositions and benefits associated with your brand and competitors.

- Product Usage – Qualitative techniques such as in-person or online focus groups, in-home use tests, and digital ethnographies explore product attributes to deliver additional consumer benefits, drive sales, and grow your brands.

Want to incorporate qualitative research and your customer’s stories into your product development process? Just give us a shout.

3 Minutes

3 Minutes